2025 marks the first year of LaunchPad under Maine Community Bank, following its merger of equals with Gorham Savings Bank on January 1st. Since 2013, LaunchPad has awarded nearly $600,000 in no-strings-attached grants to Maine’s most innovative small businesses, from AI-powered startups to sustainable seafood ventures.

PORTLAND, Maine | July 14, 2025 — Maine Community Bank launched the 2025 application for its 12th annual LaunchPad small business competition today, offering Maine-based entrepreneurs a chance to earn a $50,000 grant from the bank to scale up their innovative ventures.

“We believe in supporting entrepreneurship and helping local small businesses prosper,” said Steve deCastro, CEO of Maine Community Bank. “For over a decade, LaunchPad has proudly empowered early-stage Maine companies with funding, visibility, and local connections—the essentials for fostering a thriving business community.”

Application Process

The application process opens today, July 14, online at MCBlaunchpad.com with a submission deadline of Thursday, August 14 at 5:00pm.

Finalist Selection and Live Pitch Event

A returning panel of distinguished judges, including John Burns, Kristine Delano, and Kate McAleer, former LaunchPad winner, will evaluate finalists based on viability, scalability, uniqueness, management, impact, and their all-important pitch at the October 21 live event.

- John Burns: Director of Corporate Engagement at the University of Maine, Burns brings over 30 years of institutional investing experience. He has guided investments in over 40 Maine companies, fostering high-growth ventures in tech and sustainability.

- Kristine Delano: Wall Street veteran, strategic advisor, board director and podcast host: Delano has deep expertise in economic development and small business financing, supporting Maine’s entrepreneurs through strategic investments and mentorship.

- Kate McAleer: Founder and CEO of Bixby Chocolates, McAleer is a successful Maine entrepreneur with a track record of scaling a craft food business, offering insights into innovation and market growth. She was the Bank’s 2014 LauchPad winner.

Finalists will be notified in late September. The live pitch competition will take place on Tuesday, October 21 at the University of New England’s Innovation Hall in Portland, preceded by a 4:30pm social gathering. Finalists will pitch to the judges, with the $50,000 LaunchPad Grant and Emerging Business Award winners announced at the event’s conclusion.

Awards

The aim of the Bank’s $50,000 no-strings-attached grant is to empower the winning business to scale their vision. For example, 2024 winner Alivo used the prize money to hire two full-time positions to meet growing customer demand. The Emerging Business Award offers a $10,000 grant plus $10,000 in in-kind services (business development, marketing, and PR) from iBec Creative, Creative Imagine Group, Grove Marketing, Philbrook Public Relations, and Nu-Yar. Five additional finalists will showcase 60-second pitch videos during the live event to compete for this prize.

Apply Now

Maine-based small business owners are encouraged to apply or recommend others. Visit MCBlaunchpad.com for details and to submit applications by 5:00pm on August 14.

# # #

About the newly combined Maine Community Bank

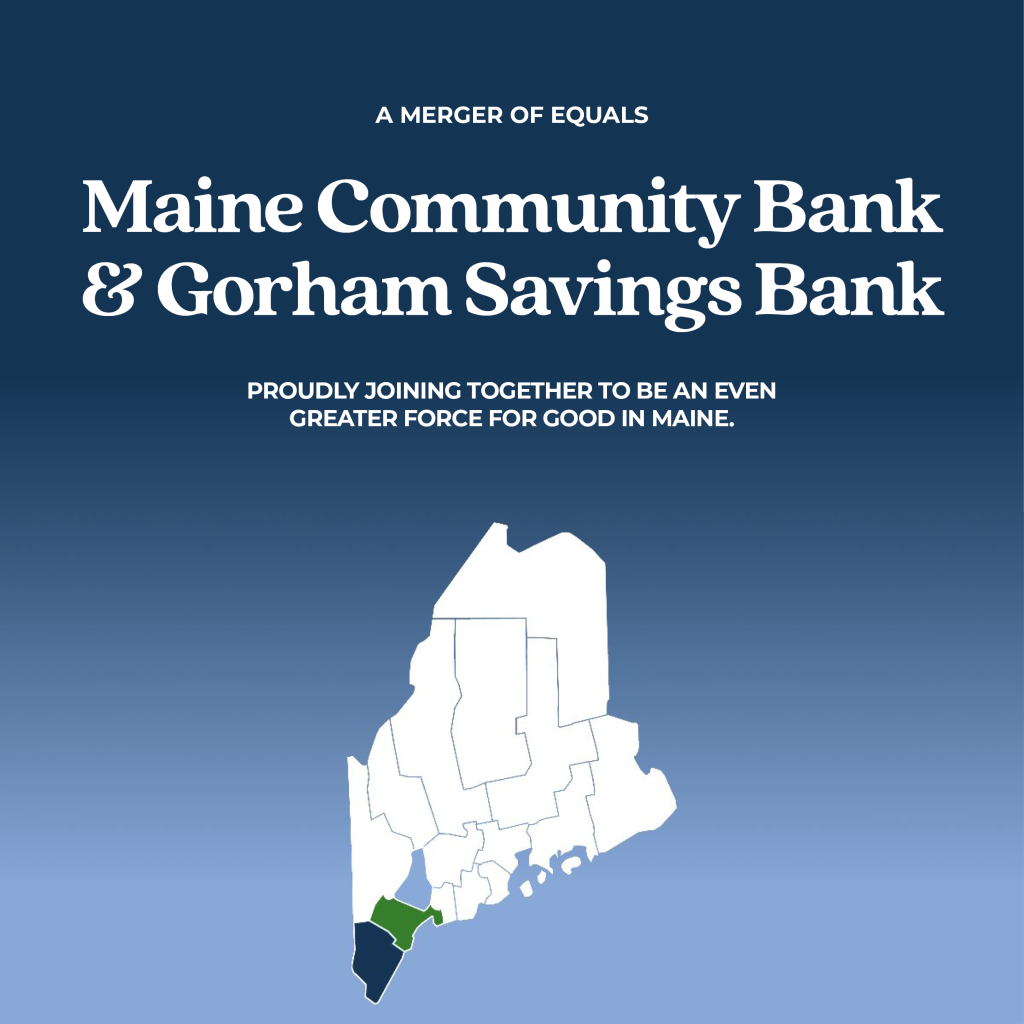

Headquartered in Portland, Maine Community Bank is the largest mutual savings bank operating exclusively in the state, with nearly $3 billion in assets and 21 branches across Androscoggin, Cumberland, and York counties. Formed from the merger of Gorham Savings Bank and Maine Community Bank—two of Maine’s longest-standing community banks with rich 150+ year heritages—the Bank combines the strengths of both institutions to create an even stronger, more capable, and more convenient institution for Maine families, businesses, and communities.

As the only bank headquartered in Cumberland County, Maine Community Bank is a depositor-owned institution committed to local decision-making and offering a comprehensive suite of both personal and business financial services, as well as wealth management.

Committed to the well-being of its communities, Maine Community Bank annually contributes thousands of volunteer hours and financial resources to community-based initiatives. By investing in local partnerships that promote financial literacy, stimulate economic growth, and foster entrepreneurship, the bank strengthens the fabric of the communities it serves. Learn more at maine.bank.

ok, Maine—June 7, 2024—Maine Community Bank is pleased to announce the addition of Deborah Roy to its’ Board of Directors.

ok, Maine—June 7, 2024—Maine Community Bank is pleased to announce the addition of Deborah Roy to its’ Board of Directors. Jeanne Hulit, President & CEO of Maine Community Bank, recently joined Maine Real Estate & Development Association (MEREDA) on their monthly podcast “MEREDA Matters” where she and Steve deCastro, President & CEO of Gorham Savings Bank, spoke regarding our merger of equals.

Jeanne Hulit, President & CEO of Maine Community Bank, recently joined Maine Real Estate & Development Association (MEREDA) on their monthly podcast “MEREDA Matters” where she and Steve deCastro, President & CEO of Gorham Savings Bank, spoke regarding our merger of equals.

The two 150-year-old financial services institutions will better serve customers, employees, and the community together

The two 150-year-old financial services institutions will better serve customers, employees, and the community together